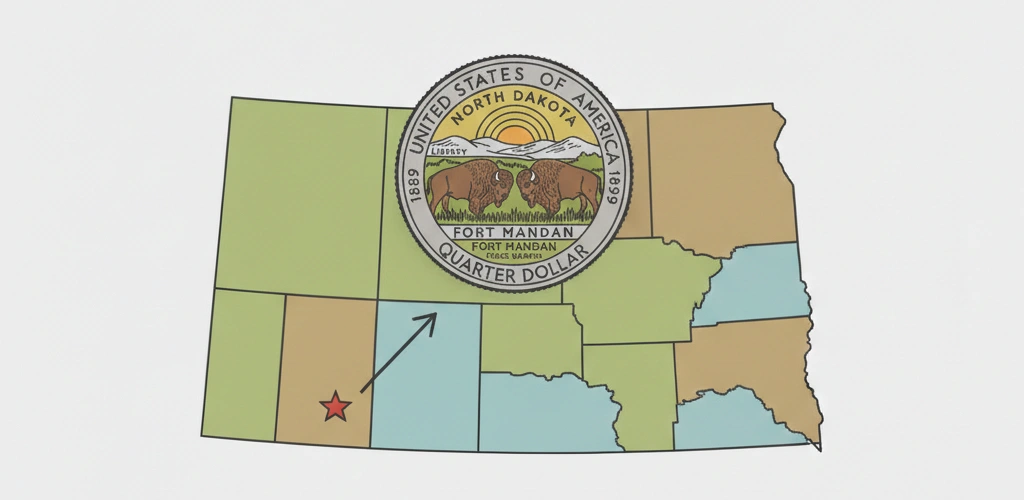

The North Dakota quarter was released on August 28, 2006, becoming the 39th coin in the "50 State Quarters" program.

Production took place at three mints: Philadelphia (P), Denver (D), and San Francisco (S).

The total mintage for circulation amounted to 664,800,000 specimens.

This volume was distributed almost equally between the two main facilities, ensuring high availability of the coin in the modern money supply.

The primary goal of the issue was the representation of the geographical and natural features of the state.

The 2006 North Dakota quarter coin possesses a standard composition for a copper-nickel quarter: a copper core with cladding made of an alloy containing 75% copper and 25% nickel.

Parameter | Value |

Denomination | 0.25 USD |

Weight (Standard) | 5.67 grams |

Diameter | 24.26 mm |

Thickness | 1.75 mm |

Material | Copper-nickel alloy |

Edge | Reeded (119 reeds) |

Analysis of Reverse Design Elements

The reverse design was developed by artist-engraver Donna Weaver.

The central part of the composition features two American bison (Bison bison) moving against the landscape of Theodore Roosevelt National Park.

The selection of this animal stems from its historical significance to the North Dakota prairie ecosystem.

In the background, Badlands formations characteristic of the western part of the state are depicted.

The inscription "North Dakota" is located at the top of the coin below the year of the state's admission to the Union (1889).

The release date (2006) and the motto "E Pluribus Unum" are found at the bottom.

The geometric arrangement of elements provides visual balance, excluding overcrowding of the coin field.

The accuracy of the bison's fur rendering and the rock textures remains a key criterion when determining die preservation.

Mintages and Distribution by Mints

Quantitative indicators of the issue determine the rarity of the coin in specific preservation categories.

The Philadelphia Mint struck 305,800,000 pieces.

The Denver Mint produced 359,000,000 pieces.

The higher figures for Denver resulted from the logistical needs of western states for fractional currency.

Proof versions intended for collector sets were minted in San Francisco in quantities of approximately 2.8 million specimens (including silver sets).

The high mintage excludes a shortage of the coin in conditions below MS65.

Coin Type | Metal | Mintage (Approximate) |

Proof | Copper-Nickel | 2,000,000 |

Silver Proof | 90% Silver | 850,000 |

Satin Finish (P+D) | Copper-Nickel | 690,000 |

Market Value and Auction Records Analysis

The market price of the North Dakota quarter directly depends on the evaluation of grading companies (PCGS, a free coin identifier app).

Coins from circulation are valued at face value (0.25 USD).

Specimens in MS65 preservation trade in the range of 1 to 3 USD.

A sharp increase in value begins at the MS67 level, where the number of confirmed specimens decreases significantly.

For the 2006-D issue, the record price for a coin in MS68 grade reached 617 USD at a Heritage auction.

The 2006-P issue in an analogous MS68 condition demonstrates figures around 400–500 USD.

Price statistics show annual volatility within 5–8% for top grades.

A 15% drop in value was observed during periods of mass release of lots from old bank rolls onto the market.

Features of the 2006-S Silver Issue

Silver North Dakota quarters have a weight of 6.25 grams, exceeding the weight of standard coins by 10%.

The pure silver content amounts to 0.1808 troy ounces.

The price of such coins consists of the metal value and a numismatic markup.

At a PR70 Deep Cameo grade (the highest rating for Proof), the coin price ranges from 40 to 60 USD.

The correlation with the precious metals market stands at 0.80, influencing the final asset valuation.

A 10% change in the silver price usually leads to a 7–9% change in the price of an uncertified coin.

Technological Errors and Rare Varieties

No major systemic die varieties have been recorded in the 2006 North Dakota issue.

Primary interest lies in individual manufacturing errors.

Discovered specimens with "clad layer delamination" are valued from 50 to 150 USD.

"Die crack" errors are encountered on the relief elements of the Badlands.

The price of such defects rarely exceeds 20 USD due to their minor impact on visual perception.

The absence of confirmed doubled dies makes grading the main tool for increasing value.

Every defect requires expert confirmation for the exclusion of artificial damage.

Price Dynamics Over the Last 10 Years

Analyzing registry data allows for tracking the investment attractiveness of the issue.

2014–2018: Stable price growth for MS68 at a level of 3% per year.

2019–2021: Increased interest in modern quarters leading to a 12% price rise.

2022–2025: Market correction of 5% resulting from an increased population of certified coins.

Investments in coins with grades below MS67 show negative returns when considering storage costs and inflation.

The certification of coins in MS66 grade is not economically justified given the cost of grading company services.

Factors Determining MS68 Grade

Obtaining the highest grade for a 2006 quarter requires an ideal condition according to three parameters.

The first parameter is the absence of contact marks on the raised parts of the bison's bodies.

The second parameter is the preservation of the primary mint luster without signs of oxidation.

The third parameter is image centering having minimal deviations from the geometric center.

The use of the coin checker app allows for identifying micro-scratches occurring when coins fall into the mint's accumulation bins.

Only 0.01% of the mintage meets the criteria for obtaining a grade above MS67.

Storage Rules for Value Preservation

Silver and copper-nickel alloys are susceptible to the effects of hydrogen sulfide and humidity.

Preserving mint luster requires the use of acid-free holders or plastic slabs.

Storage in original bank rolls does not guarantee surface preservation due to coins rubbing against each other.

Contact between skin and the metal surface leaves grease marks initiating the corrosion process.

The temperature regime in the storage location must exclude sharp fluctuations provoking micro-expansions of the metal.

The presence of patina on modern quarters is more often perceived negatively by the market, reducing the price by 20–30%.

Conclusion

The 2006 North Dakota quarter remains a mass payment instrument with limited numismatic potential.

Real value is concentrated in a narrow segment of coins in ideal preservation and silver issues.

The massive mintage ensures supply stability, excluding sharp deficit-driven price spikes.

Analysis of confirmed facts indicates the necessity of a selective approach when forming a numismatic portfolio.

Understanding the difference between face value and auction records prevents errors when evaluating random finds.